Wealth groups definition

Billionaires - Those individuals with wealth of US$1 billion or more.

Centi-millionaires - Those individuals with wealth of US$100 million or more.

Multi-millionaires - Those individuals with wealth of US$10 million or more.

Millionaires (HNWIs) - Those individuals with wealth of US$1 million or more.

Mass Affluent - Those individuals with wealth of over US$100,000.

Number of HNWIs migrating per year

2015 - 64,000

2016 - 82,000

2017 - 95,000

2018 - 108,000

The world’s wealthiest people are also the most mobile.

Worldwide, there are 14 million individuals worth at least USD1 million in net assets. Another 560,000 have net assets of USD10 million or more, 25,000 have net assets above USD10 million, and 2,140 are billionaires. That number also continues to grow and is projected to exceed USD 100 trillion by 2025. The migration of these individuals is particularly beneficial for the nations they move to. Wealthy individuals tend to have the skills, knowledge, capacity — and capital — that can increase an economy’s overall wealth and standard of living.

The only possible negative of taking in a wealthy person is that they can push property prices up to levels that locals cannot afford. However, there are controls that can be put in place to prevent this from getting out of hand, such as those introduced in Australia which prevent foreigners from buying ‘second-hand homes’ (i.e. foreigners can only buy newly built homes). This essentially forces these foreigners to sell their properties to locals at a price that locals can afford, which means prices should not be inflated (as there is no point in them paying $2 million for a house that they can only sell for $1 million).

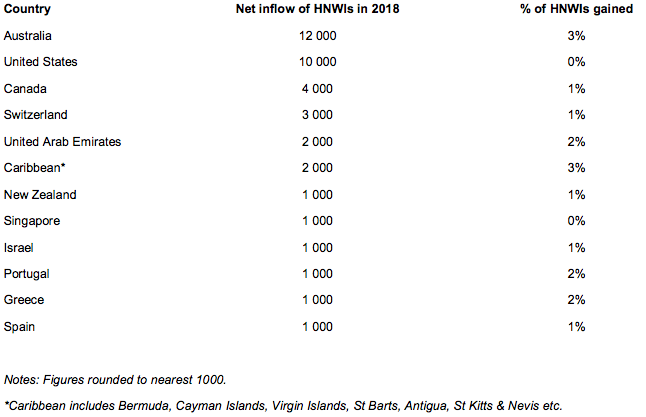

Global wealth migration is accelerating. Approximately 108,000 millionaires (HNWIs) migrated in 2018, compared to 95,000 in 2017. The following countries experienced the biggest wealth inflows in 2018.

The following countries also experienced significant (100+ HNWIs) wealth inflows during the past year.

Monaco

Malta

Mauritius

Latvia

Hong Kong

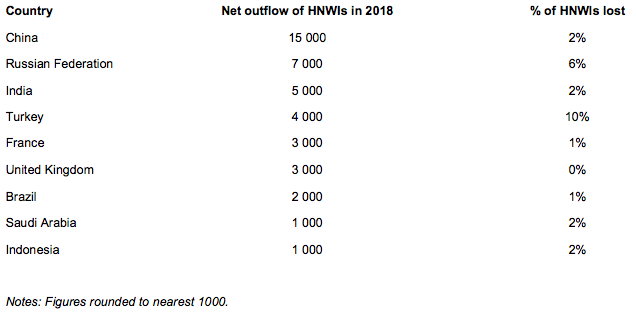

The following countries experienced the biggest wealth outflows in 2018.

The following countries also experienced significant (100+ HNWIs) wealth outflows during the past year.

Nigeria

Venezuela

Ukraine

Egypt

Lebanon

Iran

War-torn countries such as Syria, Libya and Iraq are excluded due to lack of reliable data. It is likely that they also experienced big HNWI outflows.

High net worth individuals (HNWIs) – persons with wealth over US$1 million – may decide to pick up and move for a number of reasons. In some cases they are attracted by jurisdictions with more favourable tax laws, or less pollution and crime. Sometimes, they’re simply looking for a change of scenery.

Australia was the leading destination, welcoming about 12,000 HNWIs during the year. The US came second with a net inflow of 10,000 HNWIs, while Canada was third with 4,000.

Other popular destinations included the Caribbean, Greece, Israel, New Zealand, Portugal, Spain, Singapore, Switzerland, and the United Arab Emirates (UAE).

Singapore, the only Far East country on the list, already has 222,300 wealthy residents, making it the city with the fifth-largest number of HNWIs in 2018. New York City took first place, with 377,800 resident HNWIs.

The UAE was a favoured destination, attracting 2,000 HNWIs in 2018, more than half of whom settled in Dubai.

The country seeing the biggest outflow of wealthy people was China, which lost 15,000 of its HNWIs in 2018; second was Russia with 7,000 emigrants; and third came India with 5,000. Large numbers also left Turkey and France.

The UK has historically been one of the biggest recipients of migrating HNWIs over the past 30 years. However, in the past two years the UK has lost approximately 7,000 HNWIs; 4,000 in 2017 and 3,000 in 2018. Brexit and new taxes on non-doms have been suggested as motivating factors in this downward trend.

Mechanisms of migration

Investor visa programs are becoming increasingly popular, especially with HNWIs from the Middle East and Asia. They generally require an investment of between US$300,000 and US$3 million in local property, bonds or businesses and most of this money is usually redeemable after a period of 5 years. Some programs such as the one in Malta offer citizenship right away, rather than just a residence visa.

However, despite the recent rise of such programs, it should be noted that only a fraction (around 30%) of migrating HNWIs come into countries under investor visa programs. Most still come in via second passports, work transfers, ancestry visas, spousal visas and family visas.

Future trends

Additionally, AfriAsia Bank predicted that global wealth will rise by 50% over the next decade, reaching US$321 trillion by 2027. This will again be driven by strong growth in Asia. The fastest growing wealth markets are expected to be:

Sri Lanka: Safe country, good educational standard and English speaking. Should benefit from strong growth in the local technology, manufacturing, real estate, healthcare and financial services sectors (10 year wealth growth forecast: 200%).

India: Large number of entrepreneurs, good educational system and English speaking. Strong growth forecast in the local financial services, IT, business process outsourcing, real estate, healthcare and media sectors (10 year wealth growth forecast: 200%).

Vietnam: Emerging manufacturing hub of Asia. Vietnam was the fastest growing wealth market in the world over the past decade and is expected to continue to grow strongly. We expect Vietnam wealth numbers to be boosted by strong growth in the local healthcare, manufacturing and financial services sectors (10 year wealth growth forecast: 200%).

China: Expected to benefit from strong growth in the local hi-tech, financial services, entertainment and healthcare sectors (10 year wealth growth forecast: 180%).

Mauritius: Safe country, business friendly and has low tax rates when compared to the rest of Africa.

Hotspot for migrating HNWIs. We expect it to benefit from strong growth in the local financial services sector (10 year wealth growth forecast: 150%).

Note: Forecast growth rates rounded to nearest 10%.

SOURCES: AfrAsia Bank Global Wealth Migration Review 2019

IMAGE CREDIT: WikiCommons / User:Colin